There’s no question that the greatest investment tool that exists today is the Roth IRA, especially if you’re a younger investor.

And the reason that the Roth IRA is the greatest investment tool right now is for this 1 simple reason.

And that is tax-free money, it’s awesome, right? But not if you’re putting your money in the wrong thing.

And there 4 investments, you should never, put inside the Roth IRA, also, I’m going to reveal to you the ugliest Roth IRA imposter, that you’ll want to avoid at all costs.

Can you do me a tiny favor and make sure to share this with 2 PEOPLE who are thinking of opening a Roth IRA, please?

Also, make sure to add me to your favorite social media’s WHY? Because I post on LinkedIn, Twitter, Pinterest, YouTube, and this blog.

With content that will transform you into a stronger entrepreneur and investor.

I also give discounts that you can get instant access to, so you can grab great deals on products.

Also, I hand you motivational quotes that keep you inspired and uplifted.

And lastly, it’s so you NEVER miss a blog post.

↓ ↓ ↓

Join our notification squad on Aweber

And

I see a lot of people who have a misconception about the Roth IRA, they think the Roth IRA is an investment, they think that if you open up a Roth IRA it’s going to pay you dividends or interest.

I’ll break this down for you, the Roth IRA is not an investment, if you’re not quite sure how the Roth IRA works then you need to check this video.

By Jazz Wealth Managers, where he talks about the Roth IRA Explained, | A simple explanation of the Roth IRA.

Once you understand the fundamentals, and, how the Roth IRA works, now it’s time to decide what you’re going to place inside of it? You can buy stocks, mutual funds, ETF’s, bonds, and a bunch more.

But just because you can buy a lot of different things, and place them inside a Roth IRA doesn’t mean you should, and, that’s what we’re going to talk about today.

So, what are the 4 investments that you should never put inside your Roth IRA? Well, you’re about to find out.

1. Penny Stocks

But Adventago, what are penny stocks? Well, typically a penny stock, is a stock that is trading below a certain price, mostly under $5 per share, and is usually not available on the major stock exchanges.

You can usually find it being traded over the counter, on pink sheets, and in other places like that.

But Adventago, why isn’t this a good option for me? The big reason why penny stocks have so much attention, is because people believe they can take a small amount of money and buy a lot of shares.

Here’s an example, if you’re buying 700 shares of a $0.40 stock, and, all of a sudden it goes up to $0.90, $3, or, $10, all of a sudden, you’ve made a tonne of money overnight! 😲😲😲

(Oops, sorry to ruin the fun for you, but that’s not going to happen…)

I’m not sure what the stats say on the chances of you losing money on a penny stock, but I’m going to safely bet it’s 90% or higher.

The reason why you would never want to buy penny stocks in a Roth IRA is because, you can only put in a certain amount of money each year.

Right now, the most you can put in a Roth IRA is $6,000, or $7,000 if you’re 50 years or more.

Think about it, if you put in $6000 and you put all your contribution into a penny stock, and, that penny stock fails.

That means you lost your entire Roth IRA contribution for that year, and the IRS doesn’t allow you to try again.

It takes a long time to be able to save enough to invest inside the Roth IRA, so, you don’t want to put it into something that’s going to potentially lose everything that you’ve put your blood, sweat, and tears into.

2. Short Term Bonds

Bonds are typically seen as a safe investment which they are, relatively speaking, if you were to compare them to stocks, currencies, and, CFD’S.

But what I don’t understand is why you would want to place your potential tax-free retirement investments inside a short-term bond.

Roth’s are meant for the long term, you want to put that money in and have it grown, so you can have a huge tax-free amount waiting for you later.

If you’re going to put that into a short-term bond that’s paying you next to nothing on interest, it’s not worth it.

There are different types of short-term bonds that you can buy, and place inside your Roth IRA, there are individual bonds, mutual funds that specialize in short-term bonds, or you can buy ETFs that specialize in short-term bonds.

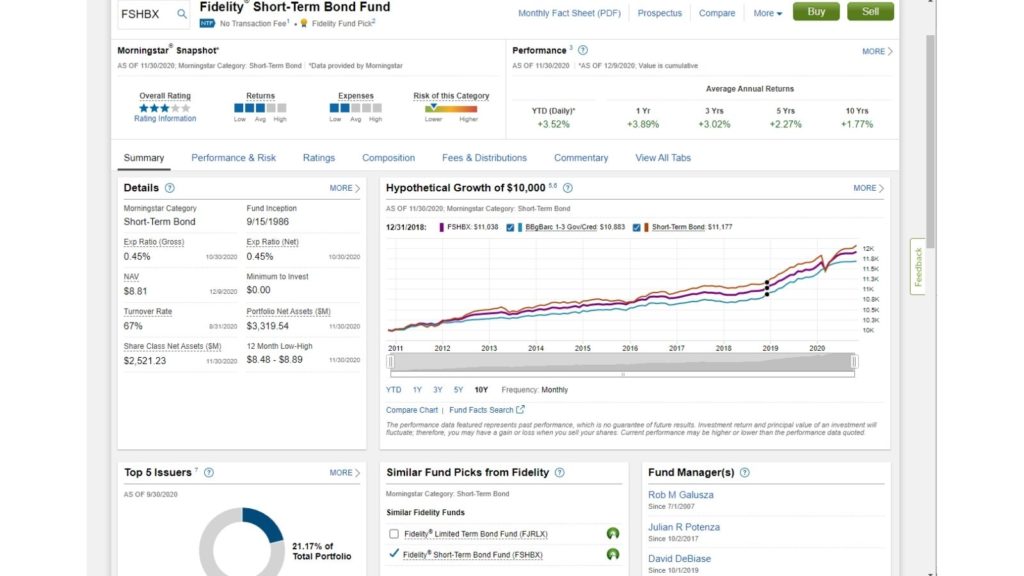

1 of those short-term bonds is the Fidelity Short-Term Bond Fund, at the time of me saying this to you, it has a yield of 1.76%.

I don’t understand, why you would want to make 1.76% especially when you have something that’s going to capitalize on compound interest, so, you can have a huge tax-free chunk of money waiting for you.

Unfortunately, that’s never going to happen if you’re only making 1.76%, another, variation of this, is with these robot advisors and investment apps.

And, how they market these, saving account alternatives, but, if you look at the marketing material it’s saying that their accounts are paying 20 times more than the national savings account rate, which is true.

But you have to realize we’re not comparing the same 2 things, we’re looking at short-term bonds and treasury bills, being compared to a savings account.

I remember some savings accounts were paying 2.25%, which is great if you’re looking at that as a savings account alternative.

But, if you’re opening up a Roth IRA, and, you’re putting that into a high yield savings account, that’s only paying you 2.25%, you’re not taking advantage of compound interest.

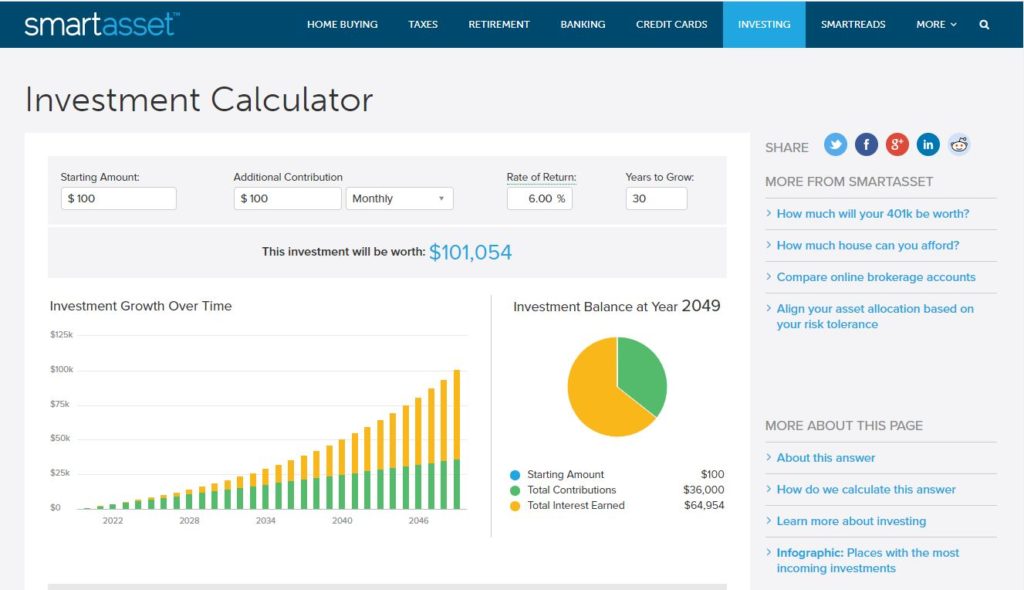

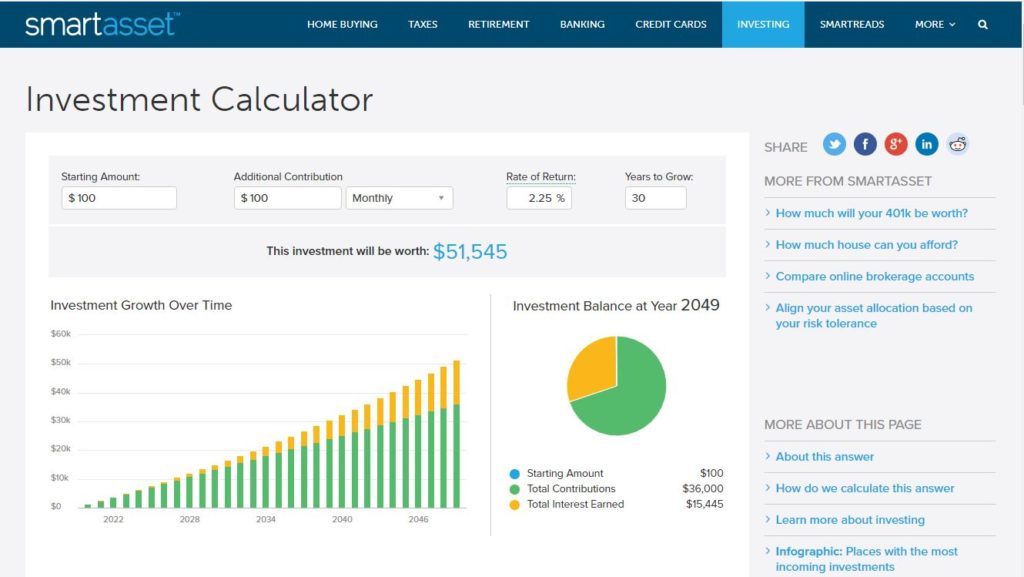

Just to show you the effect of putting your money into a high yield savings account, (Which is really just a short-term bond).

Over the long term if you’re putting $100 a month over 30 years, and, you’re making 6% interest at the end of the 30 years, you’ll have over $101,054 (A hundred and one thousand, and fifty-four Dollars).

Now, let’s say instead of making 6% on your money, you decide to put it into a high yield savings account, that’s only paying you a 2.25% interest over the same time.

The difference is, you’re only going to get $51,545 (Fifty-one thousand, five hundred and forty-five Dollars).

Can you believe that? You just gave up $49,509 (Forty-nine thousand, five hundred, and nine Dollars), all because you put it into a high yield savings account.

This emphasizes why you don’t want to have short-term bonds inside your Roth IRA.

3. Annuity

It doesn’t matter what type of annuity it is, it could be a fixed annuity, variable annuity, or a fixed indexed annuity.

If you don’t understand how annuities work, the number 1 thing you need to know is that, if you put your money inside an annuity, it already offers you tax deferral, that’s how these investment products are structured.

You’re already getting tax deferral, so, why would you put your money into an investment that already offers you tax deferral, and then, you take that and put it into a Roth IRA?

It’s not like you’re going to get double tax happiness, that’s not how it works, yet I see so many different advisors, selling annuities inside a Roth IRA and it doesn’t make sense.

This is why I hate hearing people say that they have put annuities inside a Roth IRA, because most of the time the person that bought it has no idea what they have.

They don’t realize that the annuity they bought has high fees, and high surrender charges.

Most investors have little, or no clue on how much fees are associated with annuities.

For example, the average internal expense for a variable annuity 3 to 5%, and that’s not a 1-time thing, this is per year, that you’re paying 3 to 5% on your money.

And the sneaky part is, you don’t even see it, the insurance company just slides it out, so you never even notice how much you’re being scammed.

Other than the fact, you have this investment for 10 years, and you can’t figure out why you haven’t made any money on this investment?

So, please avoid annuities, especially variable annuities inside your Roth IRA.

4. Cash

You don’t want to have cash, or at least too much cash inside your Roth IRA, if you’re opening a Roth IRA at your local bank, and the only thing that they can offer you is a savings account, money market, or CDs.

Then that’s the only rate of return you’re going to get, so if the savings account is only paying you point 1%.

Then you’re only going to make point 1%, there’s no way of making any more money, and that’s just because the bank doesn’t offer any other types of investments.

But, if you go to an investment firm, or you open a Roth IRA online, with any online brokerage, at least you can invest in a lot more things.

But so many people think that the Roth IRA is an investment, so, when they open it at their bank, and the bank only offers a savings account paying point 1%, or, half percent interest.

They think to themselves “Ah man! My Roth IRA only pays this” No! it’s only because the bank can offer you a limited number of offerings.

You’ve got to go somewhere else that allows you to put your money inside investments.

Alright so those are the 4 investments you should never place inside your Roth IRA, however, I also mentioned that there is a Roth IRA imposter, that you MUST avoid.

If you ever hear a financial advisor marketing this imposter as a “Super Roth IRA” or “A rich person Roth IRA,” that’s when you want to start saying that this person is acting suspicious!

Because they are going try to sell you something that’s complete rubbish, basically all this is an insurance policy, it could be an indexed, universal, or whole life policy.

And the whole concept is that you’re putting money inside this insurance product, it grows so-called “Tax-free “over time, and, in the end, you can take out a loan against whatever the cash balance has accumulated.

Now, this sounds great in theory, and, if you’re making so much that you’ve already maxed out your 401K, self-directed IRA, and you can’t do a Roth IRA.

Then maybe you would want to consider this as an option, however, if you’re at the point where you can’t even max out a Roth IRA yet.

Because you’re just starting in your investment journey, and this advisor is trying to sell you a “Super Roth IRA”, or a “Rich person Roth IRA”.

Let me tell you this straight up, you’ve got no business putting your money into that, until you’ve maxed out the real Roth IRA, or your real 401K.

And the only reason why, they’re trying to sell you this, is because they get paid a major fat commission, and that’s the hard, and sad truth.

The reason you get burned on this type of investment, is because these advisors will run these illustrations, and, they’ll show these predictions of how much money you’re going to have 20 or 30 years from now, that you can borrow against yourself tax-free.

It sounds awesome, but, the 1 thing they always ignore, or lie to you about, is how much it costs to have the insurance to have this product.

They never spend any time looking at those costs that you never see, so now you’re paying on this thing for 10 or 20 years.

Not realizing that you could have put your money somewhere else and made a lot more, especially, inside a Roth IRA, which would have been completely tax-free.

That’s where you have to be careful, if you have an advisor that is trying to sell you 1 of these “Super Roth IRA’s,” or, “Rich people’s Roth IRA’s,” and, you haven’t even maxed out your 401K yet, or REAL Roth IRA.

Then you need to get FAR away from that person, so please if you’ve not opened up a Roth IRA, make sure to do so, it’s super easy, you can do it online, and never have to leave your living room, also, it will MASSIVELY boost your financial future.

Can you do me a tiny favor and make sure to share this with 2 PEOPLE who are thinking of opening a Roth IRA, please?

Also, make sure to add me to your favorite social media’s WHY? Because I post on LinkedIn, Twitter, Pinterest, YouTube, and this blog.

With content that will transform you into a stronger entrepreneur and investor.

I also give discounts that you can get instant access to, so you can grab great deals on products.

Also, I hand you motivational quotes that keep you inspired and uplifted.

And lastly, it’s so you NEVER miss a blog post.

↓ ↓ ↓

Join our notification squad on Aweber

And

I hope you enjoyed this, until next time, I wish you a lovely day from Adventago. 😊

Roth IRA, how to invest, retirement investing, roth ira investment options, what is a roth ira, invest for retirement, retirement investment planning, roth ira investing strategies, invest in roth ira, jeff rose, roth ira explained, how to be wealthy and successful, how to build wealth, how to be wealthy in life, investing for beginners, how to invest money, personal finance, investment ideas, how to invest in stocks for beginners, #RothIRA, Can you lose all your money in a Roth IRA?, What is bad about a Roth IRA?, Why you shouldn’t open a Roth IRA?, Is it smart to have multiple ROTH IRAs?