You need to learn these rules about money or else, you’re going to have a really hard time in life, in this post, I’m going to go over with you the 7 Top Money Lessons I Wish I Learned Sooner, And Should Be Taught In School.

You and I going to start with rule number 7 and count all the way down to the last but most important rule of money that I wish I knew sooner.

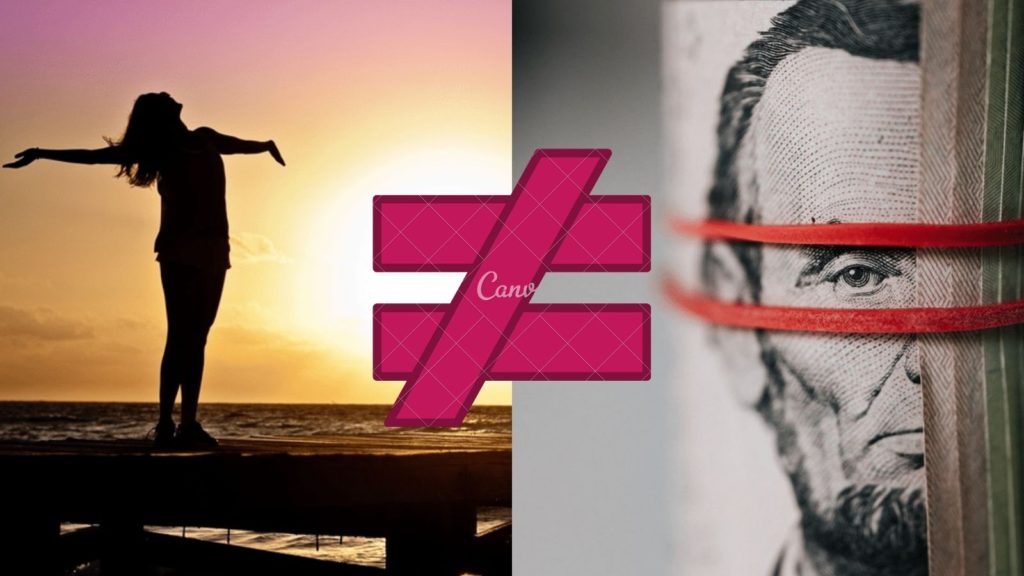

7. Money Doesn’t Make You Happy

At least not directly, and what I mean by that is money can buy you experiences, and it can buy you freedom, by being able to travel the world and go to whatever restaurants you want, skydive, and do the things you want to do, those things do make you happy, but not the paper or digits itself.

Money also buys you freedom, freedom to not worry about bills, freedom to do the things that you want to do with your time and not have to go to a job that you hate, and not have to do anything that you don’t want to do.

But understanding that money doesn’t make you happier directly, and it’s not the ultimate purpose in life is very important to understand, because you don’t want to fall victim to doing what I used to do early on in my life, which is directly tying your happiness to money, because I promise you, it’s going to be a bad time.

6. Make More, Don’t Spend Less.

I see a lot of bloggers talking about saving every penny and things like that, and while that can be reasonable advice for some people, it’s much easier and better to focus on generating more income, rather than trying to cut back, be cheap, and save every penny, at every possible corner of your life.

Not only does that make you look cheap, but it also makes you constantly worry about saving money, and saving every penny, instead of enjoying your life and having fun.

But it also takes your focus off the more important part, which is creating a business that’s smarter, that works while you’re sleeping, and can generate more income so that you don’t have to worry about cutting every cost.

Now, am I saying that you should be irresponsible? Absolutely not, what I’m saying is you want to enjoy your life and make enough money to do so, and not never have to say no to new experiences or fun opportunities, just because you’re trying to save a buck.

5. Cash Flow Is King.

And this one took me a long time to realize that cash flow is king, and what I mean by that is you can go, and you can invest into a million-dollar house, but if that house is not paying you rent, it’s probably not worth having, and it’s probably not worth adding to your portfolio.

It took me a long time to realize that cash truly is king, the more cash you have, the more cash you can invest into things, the more cash that you can invest into advertising, into more inventory, or into buying more properties.

But if you don’t have assets that are cash flowing and putting more money into your bank account, then you will cripple yourself for future investments, and the effects of compound interest won’t come towards you.

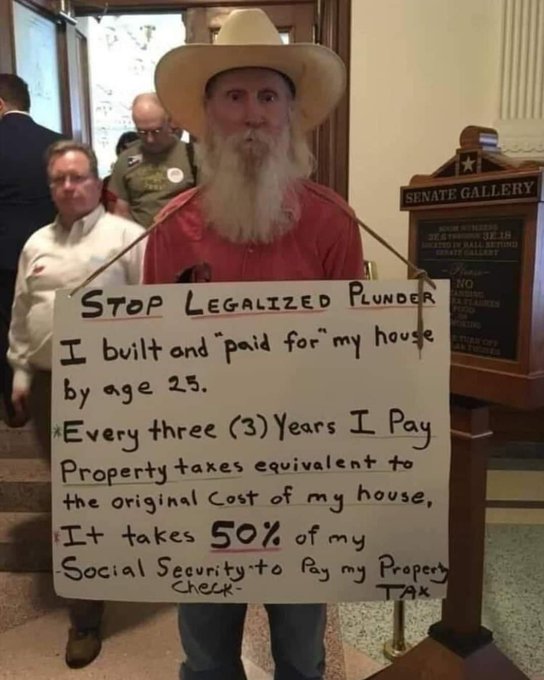

4. Don’t Live In A House You Own.

This is quite counterintuitive to a lot of the things that we learn growing up, that you shouldn’t waste money on rent, and you should buy the house that you live in.

But the problem is, if you tie up $100,000 or a million dollars in the down payment for a house, that’s money that you could have spent elsewhere on assets, that cash flow.

Not only that, but there’s also a lot of expenses that you don’t realize when you first buy a house, like property taxes, maintenance, and if things break, you’re the one responsible.

However, when you rent your house, not only do you have peace and freedom of mind, but you also don’t have to pay property taxes, homeownership fees, or repairs.

And you can use the money that you otherwise would have invested into the down payment of a house, a non-cash flowing asset, and take that and invest into multi-family, or invest into e-commerce inventory for your products, or invest into a digital marketing company, or a course, or a mentorship, or something that you can take and turn into more money.

3. Learn How To Sell, And You’ll Never Be Low On Money.

Selling is one of the most important skills that you can possibly learn as a businessperson, as an entrepreneur, or as anyone.

If you can’t convince and influence people to do the things that you ultimately want them to do, you’re never going to be successful at business.

Business is about other people and your interactions with them, vendors suppliers, new customers, clients, bosses, and your employees.

If you don’t learn how to effectively communicate and effectively sell not only your products but also your ideas, then you’re going to cripple yourself when it comes to generating more money.

If you don’t know how to sell, here are 2 posts…

And

Another little trick and this one was from Russell Brunson he calls it “Funnel hacking” This is when you go to someone’s landing page or website and you buy all their products to see how the whole page is set out.

This will help you understand what your competitors are doing, don’t think of this as wasting money, think of this as buying crucial data to make sure you give your business the best chance of success, don’t try to reinvest the wheel, model what works.

2. Taking Advantage Of The Wonders Of Compound Interest.

Albert Einstein said that compound interest is “The eighth wonder of the world, he who understands it earns it, and he who doesn’t pays it.”

And what compound interest means is whether it’s incremental actions, trying to get better, learning more about sales, reading productive books, watching educational videos, or trying to create your own business.

All those incremental actions are forms of compound interest where eventually all those incremental actions are going to explode into an exponential return, not only for yourself, but for your business, this also works with money when it comes to investing.

1. Learning The Basics About Taxes And Real Estate.

Because everybody knows that you should invest in real estate, and all the richest people in the world invest in real estate, but a lot of people don’t understand why.

Understanding the basics of how the right real estate, like multi-family, gives you cash flow but also gives you a huge amount of tax benefits.

Because it’s very important to understand that even if you earn a lot, what’s more, important is keeping that money, minimizing your taxes as much as you legally can, and taking advantage of tax strategies like depreciation, real estate, and everything that comes along with investing in real estate and generating streams of cash flow.

Thank you for spending some quality time with me, see you soon, and bye for now!

“Kevin David”, How to Think About Money – Jonathan Clements, HOW TO SAVE £10,000 ON A LOW INCOME: A NO-NONSENSE GUIDE TO MONEY MANAGEMENT – by Miss Annette Galloway, How to Manage Money: What They Don’t Teach Us in School – by Zach Turner, Business Mindset, Money Lessons