Many of us experienced a fantastic bull run in 2017 and a painful bear run in 2018, hopefully, we’ve learned a few lessons along the way.

In this blog, I’m going to be sharing with you, my top 5 must-have tips for any Crypto/Bitcoin investor or trader, to maximize your portfolio and minimize your mental pain, as we hopefully transition into a Bull Run.

But before we start, don’t forget to add me to your favorite social media WHY? Because I publish on LinkedIn, Twitter, Pinterest, Youtube, and this blog, with content that will transform you into a stronger and smarter entrepreneur, investor, and thinker.

I also give discount and referral links that you can get access to, so you can have juicy discounts and deals on equipment that you may already be thinking of getting.

(You wouldn’t want great discounts and bonuses, would you?)

Also, I hand you motivational quotes that keep you inspired and uplifted.

And lastly, it’s so you NEVER miss a blog post.

↓ ↓ ↓

Join our notification squad on Aweber

And

Tip 1: Make A Plan, But Be Nimble.

The last sounds like an oxymoron, how can you make a plan, but at the same time be nimble, surely those are opposing forces?

I haven’t been in this niche for very long, and yet I’ve seen many crypto investors, see an investment rise rapidly, or fall rapidly, then they let their emotions get the best of them.

Instead of being logical and calm investors, they become emotionally irrational investors, that is pretty much the worst thing you can do in any market, especially a market where the prices move quickly.

The best thing to do is to have an idea of what you want to do, it doesn’t have to be a master plan but, you should make a strategy that shows when you want to get in and when you want to get out.

If you don’t have that kind of plan, you’re going to see the prices shooting up or shooting down, and your emotions will take over.

At the same time, you want to be nimble, but what do I mean by that?

As a crypto investor, I can hold my hands up and say there are many occasions where I’ve got it wrong.

I’m sure most people in crypto have experienced the same thing, the key is to not be so set in one plan that you can’t adjust.

Yes, it’s good to have a plan but when that plan isn’t going well you have to be able to re-evaluate and take your ego away from the situation, and be able to say, “Look I was wrong, this is the next best step to move forwards”, and then you’re able to create a new plan.

What I’m trying to say is that, it’s good to have a plan but, at the same time you want to constantly reassess that plan and ask yourself is it still working for me? If it’s not, then throw away your ego and be willing to create a new one.

Tip 2: Take Profits

Tip number 2 is to take profits, in the last bull run, many people made life-changing sums of money and then lost it, what is the point of making a life-changing sum of money if you don’t catch anything?

I understand the temptation of people who want to be in the Bull Run for as long as possible, and quite frankly it’s impossible to pick when it will peak and when it will hit the bottom.

Therefore, a good strategy is to take gradual profits as you go along, if you ever get into a situation where you have a life-changing sums of money in crypto, it’s a good idea to cash out at a certain percentage.

Whatever the percentage is will depend on your risk tolerance, for example, I’m relatively young, and if things go completely terrible from now, and crypto somehow goes to 0.

I’m young enough that I’m okay with that, I can bounce back, however, if you’re near retirement age then you need to have a different risk tolerance.

You need to assess your own personal situation and ask yourself, “How much am I okay with making, but at the same time how much am I okay with losing?”

If you ever see your portfolio, go into the stratosphere, and you have incredible sums of money in crypto, ask yourself the question “Am I ok with losing it?”

If you are then maybe it’s okay to let it ride, if you aren’t then it’s probably time to take some of those profits, many people ask themselves one question which is, “Am I happy if it continues going higher?”

But they forget to ask themselves the question are they happy if it goes lower? And they might lose a large percentage of their holdings.

Don’t be that person, hopefully, we’ve learned from the last bull market, followed by a painful bear market.

Remember: Just as things can go up, they can go down.

Tip 3: Understand Market Dynamics

Tom Heavey said in several videos, that he has a business background, and he studied a master’s in business at university, so when Tom Heavey came into crypto for the first time, Tom Heavey focused heavily on the fundamentals.

He would do 4000-word reports on just about everything that the project was trying to do, and Tom Heavey would assess details such as token velocity.

Tom Heavy does say at times that he’s not going to explain about this in detail since he doesn’t think it’s necessary.

However, he did say this in a video.

“I think that it’s so influential that over the next 10 years we’re going to see 95% of utility tokens trend to zero, because of token velocity alone”.

– Tom Heavy

WOW, that’s incredibly impactful, and yes, after a while Tom Heavey came to realize that most people don’t understand token velocity.

And since most people don’t understand token velocity, they’re probably not factoring that into their investment decisions.

While Tom Heavy was looking at some projects and saying, “That’s a terrible token velocity, I won’t go near it!”

Many people weren’t doing the same, and as a result of the price of those tokens would sometimes increase, this is why you must understand your time frame if you’re a long-term investor.

Fundamentals are king in the long term for any market, they will eventually push out everything like hype and marketing, which are important in the short term, and fundamentals will be the most important factor.

If you’re a long-term investor it’s important to understand things like token velocity, and how, token use case is such an important element, but if you’re a short-term investor, and unfortunately, it pains me to say it.

Many people don’t understand token velocity or even sometimes token use case, so those things can be outweighed by things like hype, marketing, and speculation, now it does sound stupid.

Since even I came into the market and thought it was all about fundamentals, and I wish it was, but the truth is Tom Heavey has invested for the short term with the outlook of just fundamentals.

And it wasn’t successful, as when Tom Heavey began factoring in market dynamics, and what he means by market dynamics is understanding what causes prices to move, and then trying to spot those patterns in other projects.

For example, things like hype, marketing, and speculation, are so important that if you want to be a short-term investor, it would be naive to overlook the importance of those.

Try to understand how the market moves, not just how it should move, and you’ll be able to understand short-term movements in this market far better as a result.

Tip 4: Save Up, But Don’t Over-Invest

Here is the key factor when I say don’t over-invest: No! I don’t mean cut back on paying for good and healthy food because McDonald’s is cheaper, I’m not telling you to try and shrink the key fundamental things that you need to take care of your life.

I’m talking about small unnecessary purchases, for example, a new TV, let’s be honest you probably have a pretty good and well-running TV right now, but you’re telling yourself “Yeah but it could be better!”, But deep down you know you don’t really need a new one.

Or maybe you’re thinking of buying a bigger car, even though the car you have is still in great condition.

These 2 things can be delayed or completely forgotten without any major consequence, however, if you need something in your life that’s very different, you should not be delaying the things that are important to your fundamental living.

But, if something is a small unnecessary purchase then it could be worth considering, am I willing to give it up for a few years for the potential return of many more years?

I also say don’t over-invest, because as often as many crypto influences tell people don’t invest more than you can afford to lose, I have spoken to many people in forums and they do just that.

I beg them not to and still, some people take on too much risk in this market.

I remember speaking to a guy on Reddit and he was talking about how he invested $5,697 in Bitcoin, he honestly thought that he was going to become financially free and started telling everyone he knew about how rich and successful he was going to be soon.

The thing that made my eyes almost pop out my head was how heavily leveraged this guy was… I honestly couldn’t believe that some people have this type of crazy risk tolerance.

But do you know what happened next? He didn’t just lose a little bit of money… He lost EVERY SINGLE PENNY.

I felt so bad for him, but I want you to take this information and learn from it, so you will never have to deal with the heavy cloud of pain and shame that others have gone through.

Bitcoin could hit $50,000, but the guy on Reddit might not make any profits, as a result, he was correct that Bitcoin was going to increase, but he missed-timed it.

Also, because he took on too much risk and wasn’t able to see that risk through to the end, he was right about the long-term trend and yet wasn’t able to benefit from it.

I think there are many things you could be wrong about in this industry, that can annoy you, but that might be the single biggest one.

Could you imagine being right about this in the long term but not being able to make any profit?

Tip 5: Stay Humble

Don’t talk about Lambo’s, this applies to Tesla’s too, or any nice cars, please just don’t do it, we know from the last bull run that it’s very easy to get carried away, but we also know from the last bull run, followed by the bubble bursting.

That if we are in another bubble-type situation, we’re probably going to have another 85% correction, it’s very easy to get carried away when something goes up and you think it will never end.

But the truth is, it’s probably likely to correct a significant amount, now we are in this very early.

So, if you invest right now, I think it’s likely the correction would probably bring us down to a level like we are right now, which means a huge profit potential on the way up.

And if we can take some profits, we can maximize our portfolios, but we have to accept that we don’t know when the bull market is going to end.

And if it is a rapid bull market, a bubble-like situation is probably going to drop severely very shortly afterward.

What I recommend is number 1. Don’t talk about Lambo’s and Tesla’s, because it just sounds douchey, and no one outside of crypto likes it.

And number 2. It’s very easy to look at your portfolio daily, and get it in your head that that’s the new value.

You might start at $5,000 and by the end of this bull market you might have $50,000 and if you log on and you think $50,000 is the true value, it’s very painful to watch it drop, maybe 20% the following month when the bubble bursts.

It’s not about trying to buy Lamborghinis or trying to buy Tesla’s, and to be honest with you there’s so much more in crypto.

For example, about changing the world, but I’m approaching this conversation purely from the investing side of things.

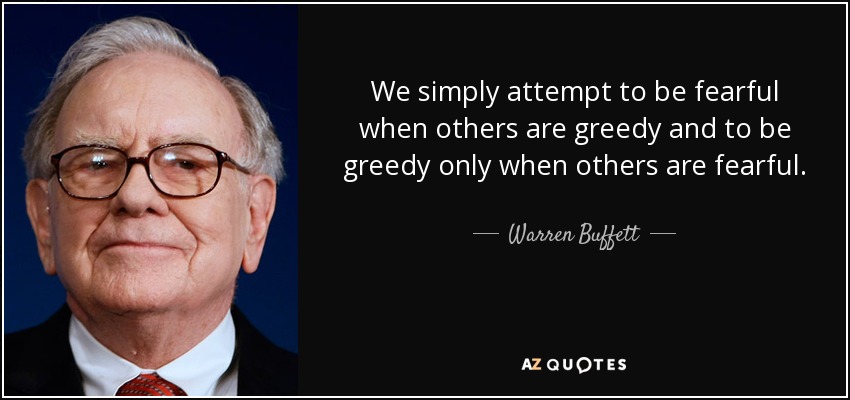

I go into other things about Crypto and Bitcoin in my other blog posts, however in this one, I’m just talking about your portfolio at the moment, so be humble and remember this great quote from Warren Buffet.

I believe that’s the best piece of advice I can give you.

If you enjoyed this blog and want to see more content just like this, hit the Green notification bell (If you’re on pc). Or the blue button (If you’re on mobile), and don’t forget to add me to your favorite social media.

WHY? Because I publish on LinkedIn, Twitter, Pinterest, YouTube, and this blog, with content that will transform you into a stronger and smarter entrepreneur, investor, and thinker.

I also give discount and referral links that you can get access to, so you can have juicy discounts and deals on equipment that you may already be thinking of getting.

(You wouldn’t want great discounts and bonuses, would you?)

Also, I hand you motivational quotes that keep you inspired and uplifted.

And lastly, it’s so you NEVER miss a blog post.

↓ ↓ ↓

Join our notification squad on Aweber

And

This has been Adventago, and once again thank you for reading, and we will speak again soon, bye for now. 😊

“bitcoin 2019\”,\”cryptocurrency 2019\”,\”bitcoin bull market\”,\”bitcoin bull run 2019\”,\”crypto bull market 2019\”,\”bitcoin investing 2019\”,\”crypto investing 2019\”,\”blockchain\”,\”ethereum\”,\”security tokens\”,\”crypto gurus\”,\”tom heavey\”,xrp news, coinbase, cryptocurrency, market bitcoin, ethereum will be bigger than bitcoin, bitcoin news, bitcoin market share, bitcoin vs ethereum investment, Is Crypto in a bull market, Should I buy Bitcoin when dropped, Crypto Analysts, bitcoin Analysts, ripple Analysts, trader, trading, trading tips for beginners, how to trade bitcoin as a beginner, how to trade btc as a beginner, btc investing, btc, bitcoin investment, how to trade cryptocurrency as a beginner, how to prepare for a bitcoin bull market, how to prepare for a cryptocurrency bull market, mistakes to avoid while trading bitcoin, mistakes to avoid when investing cryptocurrency